Nestle India Shares decrease by 2% on the stock split. Nestle India’s stock is expected to attract the attention of investors and market watchers due to its enhanced affordability following the stock subdivision. The record date for the stock split, with a 1:10 ratio, has been established by the board of directors of Nestle India Limited for January 5, 2024. As a result, ten shares with a face value of Re. 1 each will be created from one Nestle India share, which has a face value of Rs. 10.

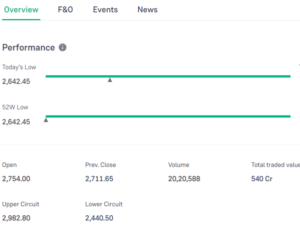

The shares of Nestle India began trading ex-split on Friday, which resulted in a decrease in share price. It began the day poorly and fell as much as 2.0% from its closing Thursday of Rs 2,711.60 per equity share to an intraday low of Rs 2,657 per share on the Bombay Stock Exchange (BSE).

Nestle India informed the stock market bourses of the stock split record date, saying, “This is to inform you that the Company has fixed Friday, 5th January 2024 as the “Record Date” for determining entitlement of Equity Shareholders for the purpose of sub-division/split of existing Equity Shares of the Company.” This was done in accordance with Regulation 42 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.”

The board of Nestle India has taken a calculated step to improve the stock’s affordability. This could result in more trading activity, and once the stock splits at a 1:10 ratio, the share price should stabilize at about Rs 2,700 per share. It should be mentioned that as of Thursday, the closing price of Nestle India shares on the NSE was Rs 27,150 a share.

Nestle India released Q2FY24 earnings that showed a 36% YoY increase in profits to Rs 908 crore and a 9.6% increase in revenues to Rs 5,036 crore.

History:

Nestlé India has a long history in India and is one of the biggest companies in the fast-moving consumer products industry. Nestle Alimentana S.A. promoted Nestlé India Limited, which was founded in New Delhi on March 28, 1959, through a wholly owned subsidiary called Nestle Holdings Ltd., located in Nassau, Bahamas.

In 1961, the firm established its first production plant in Moga, Punjab, India. Located in Choladi, Tamil Nadu, Nestlé’s second factory was established mainly to process the local tea crop.The business opened a manufacturing in Nanjangud, Karnataka, in 1989.The corporation launched Nestlé premium chocolate in 1990 to get into the confectionery market.

Nestlé opened two locations in Goa, in Ponda and Bicholim, respectively, in 1995 and 1997.

They entered the iced tea and liquid milk businesses in April 2000. The firm opened its seventh facility in Pantnagar, Uttarakhand, in 2006.

In 2011, the company added another plant, bringing its total number of units in India to eight. This was in Karnataka.

Nestle India stated in October 2020 that it would invest Rs. 2,600 crores to build a new plant in Sanand, Gujarat. Production entered its first phase on October 1, 2021.

As of December 2022, Nestlé India Limited had a market capitalization of Rs. 1,93,666.87 crore.

Information on the Nestle stock split:

In order to make the company’s shares more accessible, Nestle India is splitting its shares at a ratio of 1:10, which divides each share into ten. This indicates that Nestle’s ranking among the most expensive shares in the nation will shortly drop below sixth.

This indicates that a single Nestle India share will soon be worth one-tenth of what it is currently worth. As of Thursday, the closing price of Nestle India shares was ₹27,090.25, about two percent higher than yesterday.

Following the stock split, the share price is anticipated to be roughly one tenth, or ₹2800 per share. This implies that buying Nestle stock will become more feasible, drawing in more long-term investors.

Nestle India is currently rated sixth on Dalal Street, with MRF holding the top spot with a share price of ₹1.3 lakh each. The only companies whose shares are priced higher than Nestle are Shree Cement, MRF, Page Industries, Honeywell Automation India, and 3M India.