The price of a company is cheap in relation to its earnings when it has a low PE ratio, which is a valuation measure. Undervalued equities are often thought to have a low PE ratio.Due to their low PE ratio stocks, these businesses may have significant room for growth and ultimately produce larger profits. In the event of unfavorable market circumstances, the shares with a low PE ratio can also provide a cushion of protection.

In India, the Price-to-Earnings ratio, or PE ratio, is a widely used metric to assess how valuable a company’s stock is in relation to its earnings per share (EPS). We shall define low PE ratio stocks and provide tactics for finding them in this talk.

Lowest PE Ratio Stocks Now:

Stocks Name CMP Market Cap PE

Electrotherm (India) Ltd 979.65 ₹1,278.20 3.30

GMRP&UI 122.06 ₹8310.00 5.28

Sat Industries 118.02 ₹ 118.02 6.48

Canara Bank 112.10 ₹101682.00 6.52

J & K Bank 110.39 12155.95 6.54

Union Bank (I) 127.08 97007.86 6.85

Bank of Baroda 252.50 130576.90 6.86

Satia Industries 123.38 1233.80 6.93

SMC Global Sec. 149.83 1568.72 7.46

BPCL 352.20 152802.16 7.84

IOCL 173.13 244481.00 7.93

Bank of India 120.56 54886.96 7.96

Fusion Microfin. 287.87 2896.66 8.29

What is the PE Ratio?

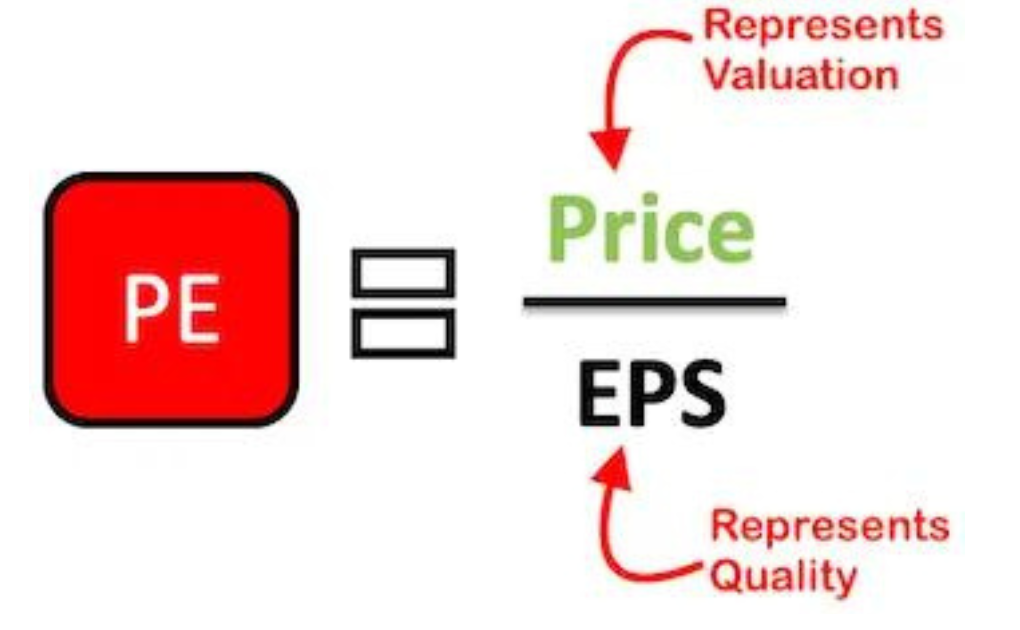

The relationship between a company’s stock price and earnings per share (EPS) is known as the Price Earnings Ratio, or P/E Ratio. This well-liked ratio helps investors understand the company’s worth. The price you must pay per unit of current earnings (or future earnings, as the case may be) is represented by the P/E ratio, which displays market expectations.

The Price Earnings Ratio Formula: What Is It?

P/E stands for profits per share divided by stock price.

or

Market capitalization divided by total net earnings is P/E.

or

Justified P/E is equal to R / G / Dividend Payout Ratio.

wherein

R is the necessary rate of return.

G stands for Sustainable Growth Rate.

Good or bad for a low PE ratio?

Paying less for every rupee of earnings is indicated by a low PE ratio, regardless of comparison to the industry or historical averages.

When a company makes 10 rupees, you are purchasing its shares at Rs 100 (Rs 10 * 10), since you are paying 10 times the earnings (10 being the PE).

However, you would pay less for the stock—that is, Rs 60 (Rs 10 * 6)—if you paid six times—a PE of six.

As a result, the cheaper the stock, the lower the P/E ratio, and equally so. On the other hand, there are situations when a low P/E ratio suggests that the business is experiencing financial difficulties.

What is a favorable PE ratio?

Nothing like a stock’s favorable price-to-earnings ratio exists. In some industries, a high price-to-earnings ratio might be detrimental.

One would prefer a low P/E ratio when searching for a list of the best value stocks. That said, the PE ratio is probably going to be high if you’re looking at a list of high growth stocks. A number of investors would probably want to purchase the company’s stock because of its explosive earnings.