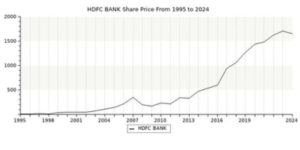

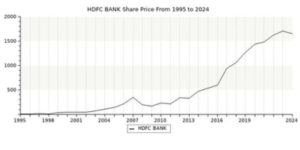

HDFC Bank’s stock fall more than 11% over the course of two days after the company’s results for the December quarter fell short of investors’ expectations.On the BSE on Thursday, the stock dropped 3.26 percent to close at Rs 1,486.80 per share. It dropped 3.70 per cent to Rs 1,480 during the day.

It fell three percent to Rs 1,490 on the NSE. The stock has down 11.44% in the last two days. The market capitalization (mcap) of the company decreased by Rs 1,45,889.59 crore during this period. On Thursday, its market value was Rs 11,28,850.63 crore.

Of the 30 share BSE Sensex corporations, the stock was the largest drag.The 30-share Nifty dropped 109.70 points, or 0.51%, to 21,462.25, while the 30-share BSE Sensex sank 313.90 points, or 0.44 percent, to close at 71,186.86. On Wednesday, HDFC Bank’s stock dropped by more than 8%. In comparison to the previous September quarter’s Rs 16,811 crore, HDFC Bank reported a 2.65% increase in consolidated net profit to Rs 17,258 crore for the October–December period on Tuesday.

The biggest private sector lender posted a net profit of Rs 16,372 crore on a standalone basis, up from Rs 15,976 crore in the same quarter last year after merging mortgage lender parent HDFC into itself in July. “A mixed quarter was reported by HDFC Bank,” according a Motilal Oswal Research report.

According to exchange records, its other income for the quarter was Rs 11,140 crore, while its core net interest income increased to Rs 28,470 crore. Regarding asset quality, the gross non-performing assets ratio improved, coming in at 1.26 percent as opposed to 1.34 percent during the previous quarter.