Top 10 Stocks With the Highest Returns: A stock achieves its greatest price in the last ten years when it reaches its 10-year high. Why create a method for finding equities with high returns when it is so easy to do so? It is necessary since depending just on historical return figures may cause issues. These stocks may be signs of a strong and stable business because they show substantial long-term growth and ongoing investor confidence.

For those who are willing to take on risk and are looking for significant returns, investing in high return stocks can be lucrative. Nonetheless, it necessitates a dedication to in-depth study, endurance to market swings, and smart decision-making. Before pursuing this exciting yet possibly profitable investing path, consider your investment objectives and risk tolerance.

India’s Top 10 Stocks With the Highest Returns Over the Past 10 Years

S.NO. Name P/E Mar Cap Rs. ROCE% 10Y Returns%

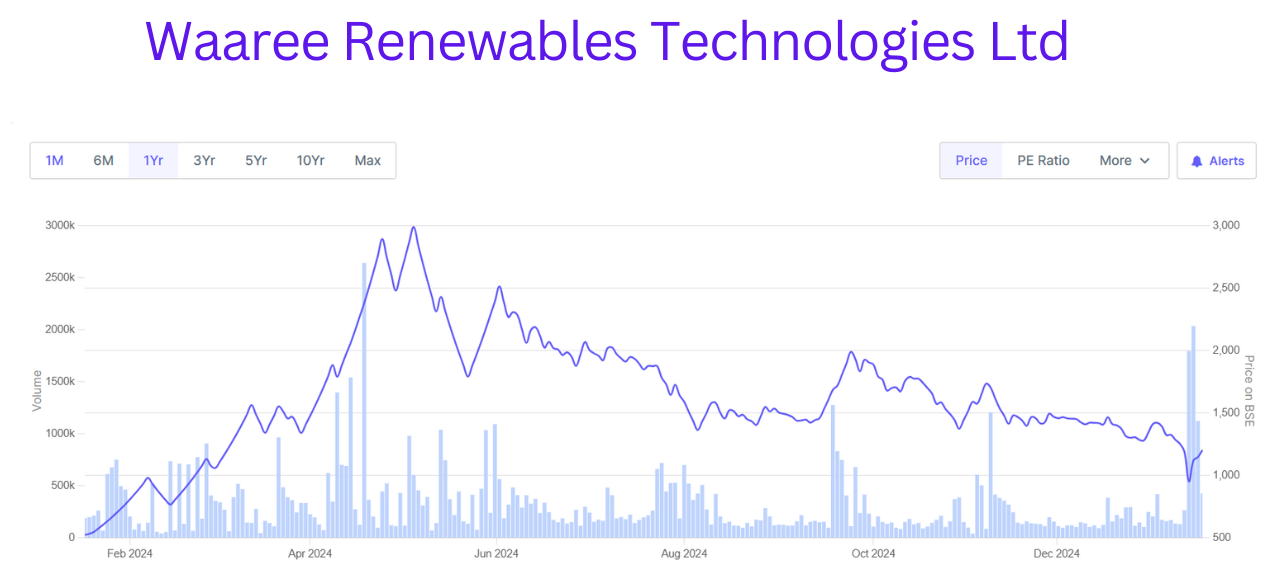

1 Waaree Renewab 61.60 12263.55 107.10 86.67

2 Lloyds Metals 51.80 76048.18 78.27 76.58

3 Jyoti Resins 21.89 1538.46 65.88 74.75

4 Fischer Medical 2052.91 3777.38 5.25 73.94

5 Refex Industries 56.22 6212.37 26.39 70.38

6 Tanfac Inds 54.64 2914.70 33.21 70.56

7 3B Blackbio 39.14 1686.67 20.95 70.22

8 NIBE 64.09 2221.47 18.54 66.56

9 Eraaya Lifespace 1860.67 2251.65 7.00 65.39

10 RIR Power Electr 264.20 2316.25 19.49 63.19

1.Waaree Renewab

Advantages

A strong quarter is anticipated from the company.

The company has a strong track record of return on equity (ROE) and has produced significant profit growth of 244% CAGR over the last five years: ROE for 3 Years: 73.8%

The median sales increase for the company over the last ten years is 123%.

Drawbacks

At 38.2 times its book value, the stock is now trading.

The company has 156 days of outstanding debt.

2.Lloyds Metals

Advantages

The business has nearly no debt.

A strong quarter is anticipated from the company.

The company has a strong track record of return on equity (ROE) and has produced good profit growth over the last five years, with a 129% CAGR: Three Years 65.0% ROE

Drawbacks

At 13.1 times its book value, the stock is now trading.

Over the past three years, promoter holdings have declined: -5.92 percent

3. Jyoti Resins

Advantages

The business has nearly no debt.

Over the past five years, the company has produced strong profit growth at a 98.1% CAGR.

The company’s track record for return on equity (ROE) is favorable: ROE for 3 Years: 48.2%

Over the past ten years, the company’s median sales growth has been 31.7%.

Drawbacks

At 8.01 times its book value, the stock is now trading.

4. Fischer Medical

Advantages

The business has nearly no debt.

Drawbacks

At 46.7 times its book value, the stock is currently trading.

The company has 398 days of outstanding debt.

5.Refex Industries Ltd

Advantages

Over the last five years, the company has shown good profit growth at a 24.1% CAGR. Cons

At 9.26 times its book value, the stock is now trading.

Compared to last quarter, promoter holdings have dropped: -3.63%

Reasons to Invest in High Return Stocks

- High Return Stocks offer a way to build money carefully, but investors must use their judgment and seize market chances to increase their wealth.

- High return stocks attract to investors looking for remarkable returns on their investments because they provide the promise of large financial benefits.

- Investors that actively seek out and take advantage of trends in order to optimize their investment returns are drawn to these companies since they thrive on dynamic market opportunities.

Benefits of Buying High-Return Stocks

- Potential for Strategic Growth

Buying these stocks allows strategic growth, and over time, wise choices can result in significant financial advantages. - Increasing Wealth

By taking advantage of the potential for large gains, high return stocks give investors the chance to greatly increase their wealth. - Advantage in a Dynamic Market

In dynamic markets, investors benefit from actively following trends and seizing opportunities to maximize profits. - Maximized Profits

The main benefit is the possibility of optimal returns, which makes High Return Stocks a desirable option for investors looking for a profitable investment path. - Ability to Adjust to Trends

Investors can align their portfolios with shifting dynamics for sustained growth because these stocks can adjust to changing market patterns.

Who should to think about making investments in high-return stocks?

- Investors Who Can Handle Risk

High Return Stocks are appropriate for individuals who are at ease with risk and are looking for the possibility of significant profits even under erratic market conditions. - Investors with a strategic mindset

High Return Stocks may appeal to investors with a strategic mindset who are able to make wise choices and seize market chances. - Seekers of Portfolio Growth

High Return Stocks may be a good fit for investors that want to increase their portfolios significantly and are prepared to actively follow changing market trends.

Considerations to make before investing high-return stocks

- Analysis of Risk: Assess your level of risk tolerance while keeping in mind that high return potential frequently entails more market volatility and unpredictability.

- Market Views: Keep yourself updated on market dynamics and trends because a solid grasp of the market will help you make wise investing choices.

- Financial Goals: Your financial goals and investment objectives should be well defined and in line with the possible risks and benefits of high return stocks.

- Strategy for Diversity: Take into account the role that high return stocks play in your entire portfolio diversification plan to guarantee a well-rounded and prudent investing strategy.

- Border of Time: Evaluate your investing time horizon because High Return Stocks could need a longer-term outlook to withstand market swings and reach their maximum potential.

Disclaimer: The shares listed are not suggestions. This website is not a source of investment advice or personal opinions. The only goal of writing this blog is to educate readers. In order to gain a self-aware viewpoint regarding investment choices, users had to carry out their own investigations and analyses.

Market risks might affect investments in the securities market; thoroughly review all relevant documentation before making an investment.